How does Clear My Car work?

We have developed an easy to use online portal. You simply complete the short application form online and pay the fixed fee of £125.

This activates your online portal where we have a checklist to easily upload the few documents we need.

Once uploaded we process the entry and email you the amount to pay HMRC (if applicable) and a link to do so directly with them.

Once paid we then have NOVA issued and emailed to you.

We operate a fleet of car transporters, is ClearMyCar for us?

Yes! Our system enables you to provide your customers with an online portal where they can upload the documentation and information that you need to ship their car to / from the UK.

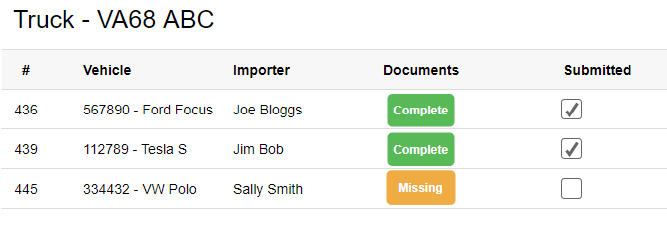

See an overview of your current customs entries, which documentation you still need from customers and the customs status of individual imports / exports.

I am importing a car from the USA, how much tax or duty will I pay?

This varies depending on what you are importing. Generally if the car is under thirty years of age, you will pay 10% duty and 20% VAT.

If the vehicle is over thirty years of age, there is no duty and just 5% VAT.

I am buying a used car from the EU, does Brexit mean I will pay taxes?

As a private individual, you will have to pay 20% VAT.